The Definitive Guide to Medicare Graham

Wiki Article

Little Known Questions About Medicare Graham.

Table of ContentsMedicare Graham - An OverviewHow Medicare Graham can Save You Time, Stress, and Money.Some Known Details About Medicare Graham All About Medicare GrahamFacts About Medicare Graham Uncovered

Prior to we talk regarding what to ask, let's speak about that to ask. For many, their Medicare trip begins straight with , the main site run by The Centers for Medicare and Medicaid Solutions.

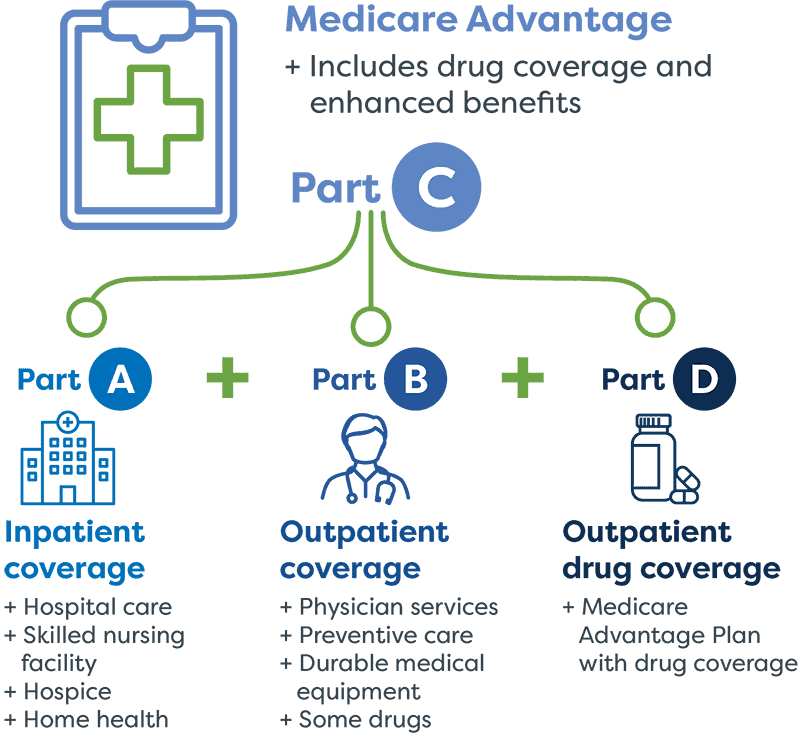

It covers Part A (hospital insurance policy) and Component B (medical insurance coverage). These plans work as a different to Initial Medicare while using more benefits.

Medicare Component D prepares help cover the price of the prescription medicines you take in the house, like your everyday medicines. You can enroll in a different Part D plan to add medication protection to Original Medicare, a Medicare Price plan or a few various other types of plans. For many, this is often the very first inquiry considered when looking for a Medicare plan.

The smart Trick of Medicare Graham That Nobody is Discussing

To obtain the most cost-efficient health and wellness treatment, you'll desire all the services you make use of to be covered by your Medicare strategy. Your strategy pays every little thing.

, as well as protection while you're traveling domestically. If you intend on taking a trip, make sure to ask your Medicare consultant regarding what is and isn't covered. Possibly you have actually been with your current physician for a while, and you want to keep seeing them.

More About Medicare Graham

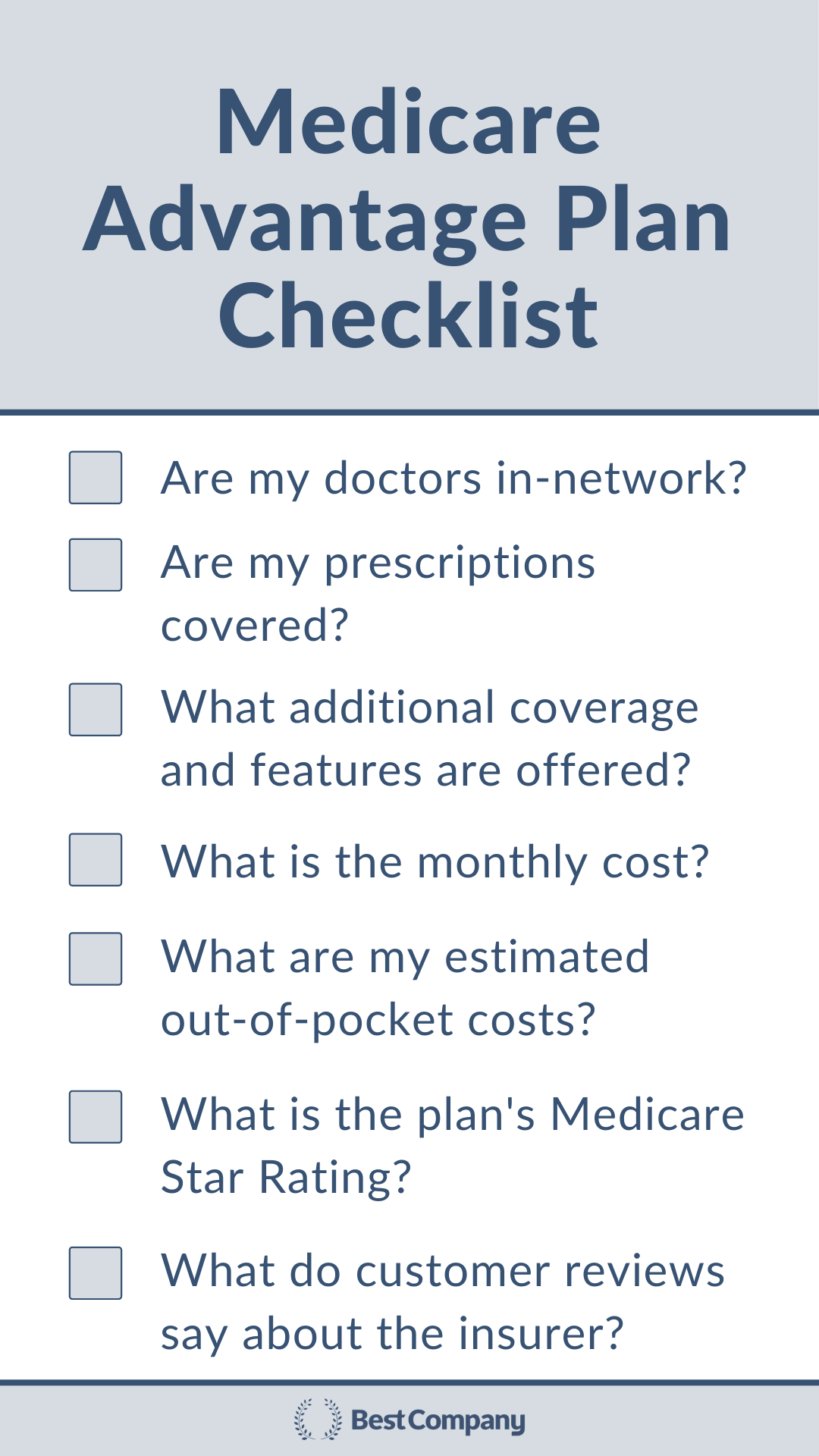

Many individuals who make the button to Medicare proceed seeing their normal medical professional, however, for some, it's not that straightforward. If you're functioning with a Medicare consultant, you can ask them if your medical professional will certainly be in network with your brand-new plan. If you're looking at strategies individually, you may have to click some links and make some phone calls.For Medicare Advantage strategies and Price strategies, you can call the insurance coverage business to see to it the doctors you wish to see are covered by the plan you want. You can additionally inspect the plan's internet site to see if they have an on-line search tool to locate a protected physician or clinic.

So, which Medicare strategy should you choose? That's the finest part you have alternatives. And ultimately, the choice depends on you. Keep in mind, when starting, it is essential to make certain you're as educated as feasible. Begin with a listing of considerations, see to it you're asking the ideal questions and start focusing on what sort of strategy will certainly best serve you and your demands.

A Biased View of Medicare Graham

Are you ready to turn 65 and end up being newly eligible for Medicare? Picking a plan is a big decisionand it's not always a simple one. There are crucial points you should know in advance. The least costly plan is not necessarily the best alternative, and neither is the most pricey strategy.Even if you are 65 and still working, it's a great idea to review your choices. People obtaining Social Safety and security advantages when transforming 65 will be instantly enlisted in Medicare Parts A and B. Based upon your employment situation and healthcare choices, you might require to think about registering in Medicare.

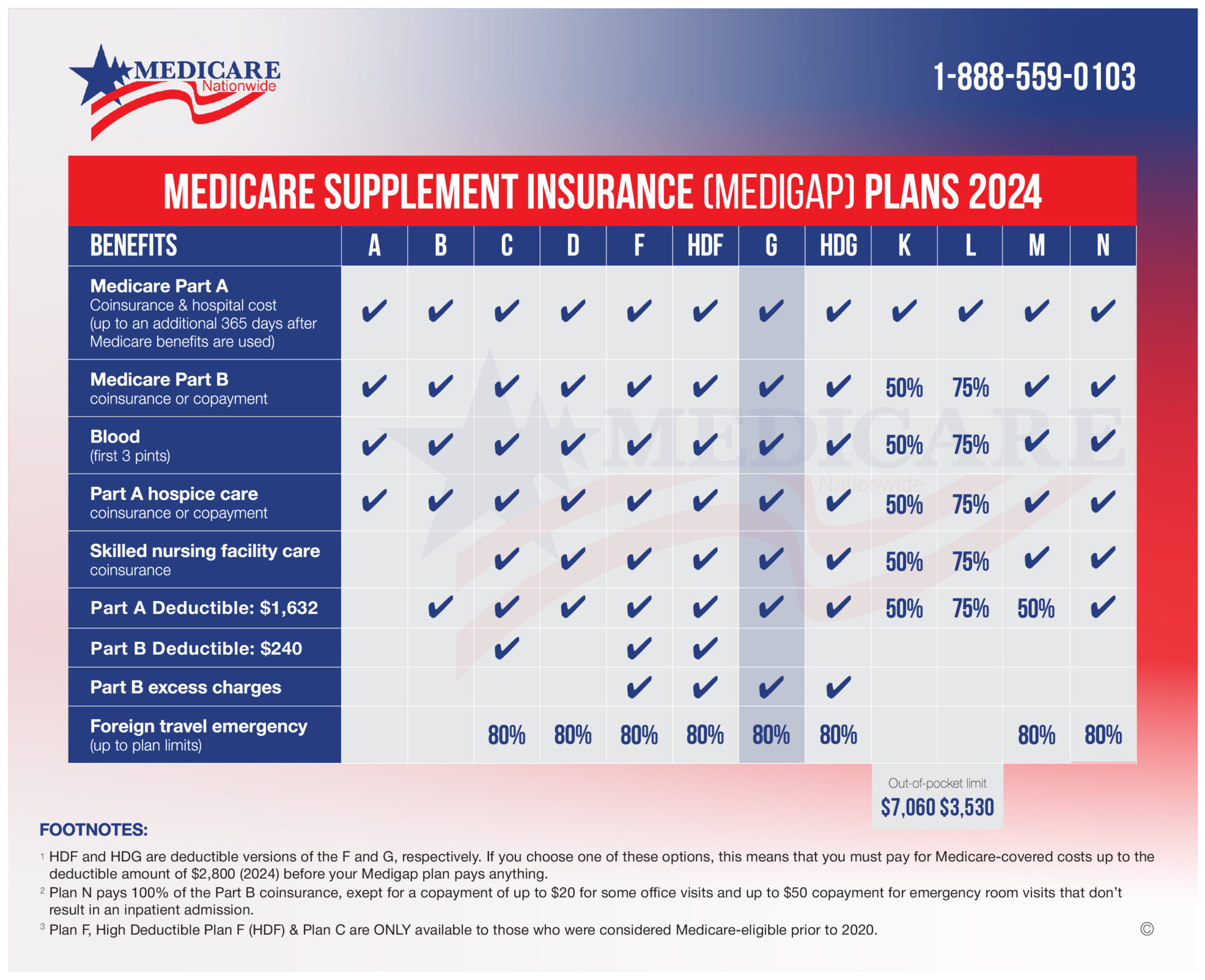

Think about the various kinds of Medicare plans readily available. Original Medicare has 2 components: Component A covers hospitalization and Component B covers medical expenses. Numerous individuals discover that Components A and B with each other still leave spaces in what is covered, so they buy a Medicare supplement (or Medigap) plan.

About Medicare Graham

There is typically a premium for Component C plans on top of the Part B costs, although some Medicare Benefit intends deal zero-premium strategies. Medicare. Review the protection information, prices, and any type of fringe benefits supplied by each plan you're considering. If you sign up in initial Medicare (Components A and B), linked here your premiums and coverage will be the same as other individuals who have Medicare

(https://www.cheaperseeker.com/u/m3dc4regrham)This is the most a Medicare Advantage participant will certainly have to pay out-of-pocket for covered services each year. The amount varies by plan, however when you get to that restriction, you'll pay absolutely nothing for protected Component A and Component B services for the remainder of the year.

Report this wiki page